Most product companies do not suffer from a lack of metrics. They suffer from a lack of alignment between what is measured and what actually drives outcomes.

Revenue growth, CAC, LTV, churn, net revenue retention, and payback remain the foundation of any executive dashboard. They are necessary for understanding financial health, forecasting, and investor communication. That has not changed.

What has changed is the buying environment. The Brooks Group research shows that the average B2B buying committee now includes six to ten stakeholders, each conducting independent research and driving multiple brand interactions before a purchase decision is made, which contributes to the large number of hidden touches that do not appear in traditional attribution measurement.

Modern product businesses operate in markets where decisions are shaped by repeated exposure, trust, and education over time, not by single touchpoints. As a result, traditional metrics explain outcomes, but rarely explain why those outcomes occurred or how to influence them next.

When traditional metrics stop explaining reality

Research across B2B buying behavior consistently shows that purchase decisions are made after multiple interactions with a brand, often across many stakeholders.

By the time a buyer formally engages with sales, much of the decision has already happened through peer conversations, prior experience, informal recommendations, and internal alignment.

This creates a structural limitation for attribution. Marketing systems capture what is measurable, not necessarily what is influential. As a result, executives often see strong lead volume and healthy pipelines without a clear understanding of which relationships are actually progressing and which are at risk.

In contrast, mobile businesses can often engineer visibility through web-to-app flows, identity resolution, and controlled onboarding. In those environments, it is easier to trace conversion and retention back to specific product and funnel decisions.

In B2B and B2B2C, that level of clarity is rare. The implication is not that metrics are useless, but that they need to be complemented with signals that reflect how relationships and value are built in that market.

Measuring more than lead quantity

One of the biggest gaps in most executive dashboards is the absence of metrics that reflect relationship quality.

Many companies optimize for the number of leads, meetings, or opportunities without understanding whether those interactions are building real momentum. A high volume of activity can coexist with weak alignment and fragile deals. This is where automation and consolidation matter.

Automating communication across sales and customer success creates consistency and reduces reliance on individual effort. More importantly, consolidating those interactions into a single executive view makes it possible to track signals that are otherwise fragmented.

Examples of relationship-focused metrics that exist but are underused at the executive level include stakeholder engagement depth across an account, interaction continuity over time, and continuity of post-sales engagement. These metrics do not replace pipeline or revenue numbers. They explain them.

When executives can see whether an account is single-threaded or broadly engaged, whether communication has stalled, or whether value-oriented interactions are happening consistently, they gain early visibility into risk and opportunity.

From attribution to control through one view

Rather than trying to fix attribution, leading companies focus on control.

This means consolidating signals from sales activity, customer success communication, and product usage into one dashboard that reflects how relationships and adoption are evolving.

It allows executives to move from reacting to outcomes to intervening earlier in the cycle.

When relationship signals weaken, action can be taken before deals are lost. When engagement drops after onboarding, education can be reinforced before churn materializes. When product exposure remains shallow, expectations can be reset before expansion is attempted.

Retention is the economic metric too many teams underweight

Many SaaS and product companies remain heavily acquisition-driven. Significant effort is spent optimizing ROAS, expanding top of funnel volume, and accelerating conversion.

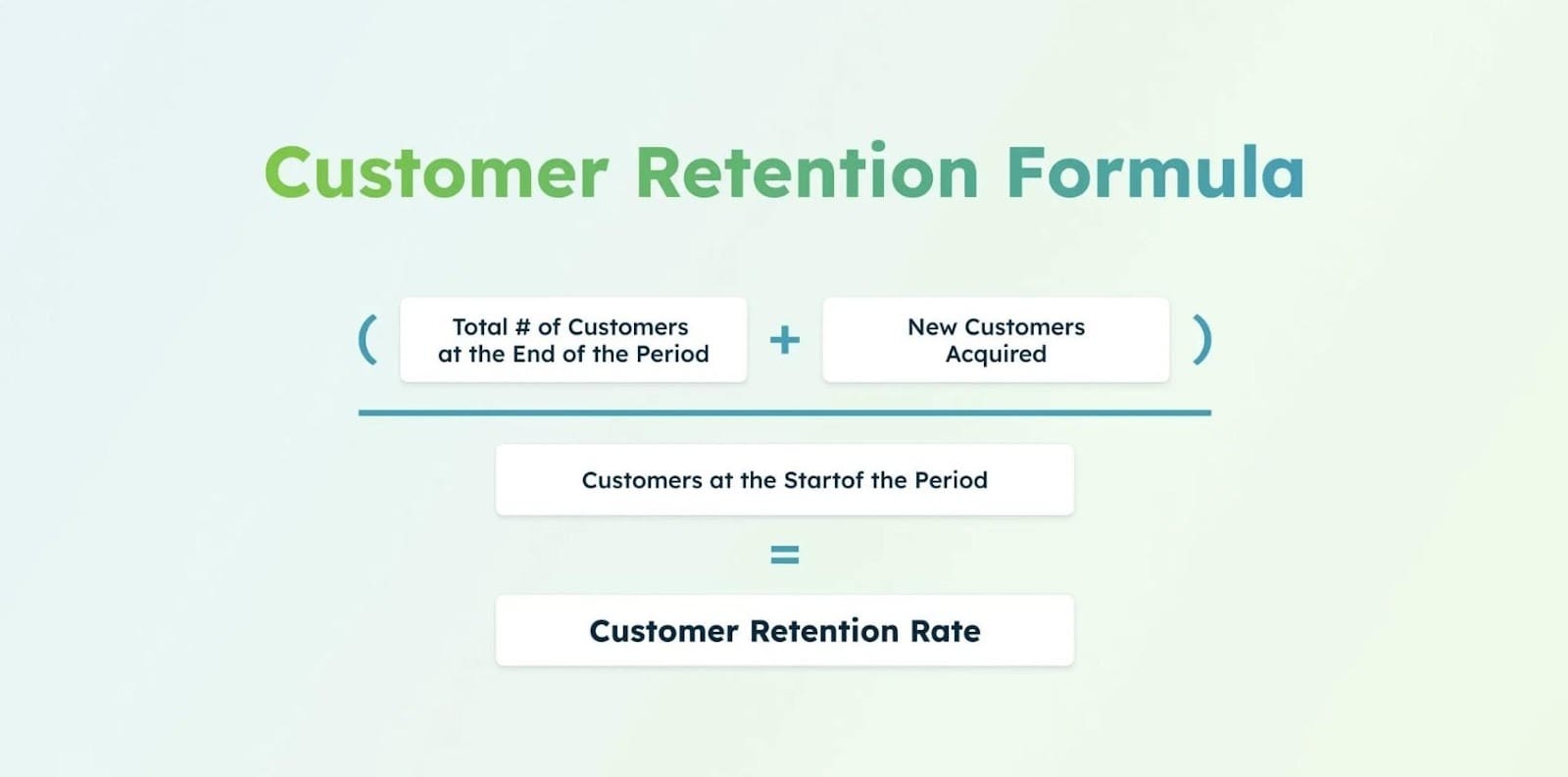

Retention is often discussed, but treated as secondary, while according to Gainsight Software, small improvements have increased profitability as much as 25 to 95%.

Acquiring new customers costs materially more than retaining existing ones. Small improvements in retention have a disproportionate impact on profitability and long-term revenue. Early retention, particularly in the first one to three months, is often more predictive of sustainable growth than acquisition volume.

When retention breaks early, acquisition efficiency stops mattering. ROAS does not matter if users churn after the first month. Discounts do not matter if revenue fails to compound as forecasted. Longer commitment terms do not prevent churn unless the product operates in a monopolized niche.

Retention is not a soft metric. It is an economic driver. According to Software Equity Blog, SaaS companies with high retention grow more efficiently, have more predictable revenue streams, and receive higher valuations in mergers and acquisitions. Strong retention is interpreted by investors as evidence of product stickiness and sustainable demand.

Product quality is necessary, education is equally critical

Building a high-quality product is a prerequisite, but it is not sufficient.

Users need to understand how to extract value from the product. Education, onboarding, and guided usage are as important as feature development. Gamification, structured onboarding paths, and clear value reinforcement are not growth hacks - they are mechanisms for improving retention and lifetime value.

A product that is not fully understood cannot retain users long-term, regardless of how strong acquisition performance looks on paper.

This is why post-acquisition metrics deserve far more attention at the executive level. Adoption consistency, early retention, and engagement progression should be viewed as leading indicators of revenue quality, not operational details.

What the C-suite should actually optimize for

The metrics that really matter are the ones that reduce uncertainty and enable earlier decisions.

That means combining foundational financial metrics with market-specific relationship signals and post-acquisition performance indicators. It means automating and consolidating communication across sales and customer success. It means treating retention and education as strategic priorities, not downstream fixes.

Executives do not need more dashboards. They need one view that reflects how value is created, reinforced, and retained over time.

Follow us on LinkedIn

Follow us on LinkedIn

.svg)

Start the conversation

Become a member of Product Marketing Alliance to start commenting.

Sign up now