Data analysis is a broad and often complex subject to get to grips with, it can overwhelm even the most capable of product marketers. In an attempt to simplify these misunderstood methods, let’s break them down into two different types of data: qualitative and quantitative.

In this article, we’ll be weighing up their benefits and deciding which is better for analysis, but first, let’s take a look at the definition and the key differences between the two.

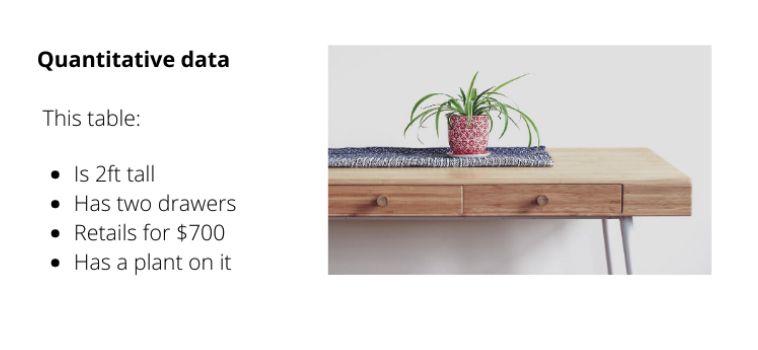

What is quantitative data?

Quantitative research includes cold, hard facts that can be easily converted into graphs and charts. The research is usually carried out using surveys and questionnaires with closed-ended questions, yes or no questions, checkbox or multiple-choice questions, and questions with intervals or ratios. It’s structured, statistical, and number-based.

What are the benefits of quantitative data?

Quantitative data is useful for conclusive answers, it’s easy to analyze and can help prove or disprove hypotheses. The questions are also quicker and easier to answer, so you’re more likely to get more responses.

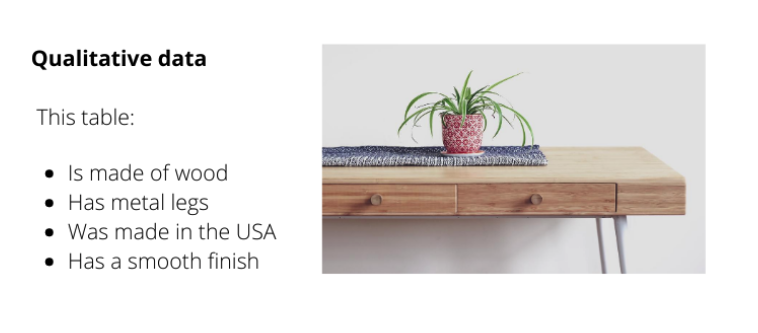

What is qualitative data?

Qualitative data is non-statistical and consists of impressions, opinions, and views. It’s generally used to answer ‘why’ questions. It’s investigative in nature and asks open-ended questions.

Qualitative data can be generated through:

- Texts and documents

- Audio and video recordings

- Images and symbols

- Interview transcripts and focus groups

- Observations and notes

What are the benefits of qualitative data?

Qualitative research gives you a deeper insight into the motivations behind the statistics. It’s used to theorize and interpret, and instead of asking how many people buy your product, it asks why they buy or why they’re not buying it.

Which is better for analysis?

Whether or not you decide to use qualitative or quantitative research will depend on the results you’re looking for.

If, for example, your product was an app that maps bike routes, using qualitative questions like “What do you think of our app?” will lead to many, many different answers, they might focus on speed, responsiveness and price, which could actually be really invaluable information for you to look at. However, if you want a specific question answering, like:

“How responsive is this app?”

- Super responsive

- Sometimes responsive

- Not at all

Quantitative data is your best bet.

How to gather qualitative data

We’d wholeheartedly recommend you conduct any qualitative research on the phone or by talking to people in-person. By seeing and/or hearing the interviewee you’ll be able to gauge their true inflections. Do they sound happy or disgruntled? Do they sigh before mentioning a certain event? All of these things can change the intent behind someone’s answer, and all of them can go unnoticed without human interaction.

There are times when qualitative research can also lead to quantitative data, for example, win-loss interviews and feedback calls. Although you’ll have a standard set of questions these call’s rarely stay on script, a particular answer will trigger another question or will warrant a deeper analysis, and this kind of data is invaluable and not something that a survey can offer the opportunity to explore.

Generative vs evaluative research

There are typically two types of qualitative research you’ll come across as a product marketer, generative and evaluative (sometimes referred to as exploratory and discovery).

Generative research is usually led by product marketing and involves developing a deeper understanding of users so that you can pre-empt problems and offer solutions, as well as driving innovation. This type of research influences product roadmaps and strategies.

Evaluative research, on the other hand, is usually owned by product management and involves testing your existing solution to see if it meets the user's needs. This type of research should be conducted throughout the development lifecycle, from early concept design to the final site, app or product, to ensure what you’re building will actually be used and benefit the end-user.

How are product marketers using qualitative and quantitative data?

We reached out to our Slack Community to find out which areas qualitative and quantitative research comes into play, here’s what they had to say:

Testing messaging

“Once you have your goal, target market, and value proposition, you can start testing messaging. This may be in focus groups six months before launch or in PPC pre-order tests, three months before launch or in customer interviews and follow-up surveys one year before launch...or in post-launch optimization tests.

“There are a lot of different ways to do this. One is to give different messages to focus groups representing the target segment to get them talking about the different angles. Another is to just interview target customers 1-on-1 to get their input. These are the qualitative aspects of message testing. Then you can consider quantitative aspects as a follow-up such as giving people surveys and asking them which of the four messages resonates most with them....or you could run A/B tests on Facebook ads and Google search ads.” - Dekker Fraser, SaaS Marketing Consultant

Post-launch feedback

“A common practice is to generate a pop-up window after a few user sessions to ask t opinion; if they like you, invite them to leave a review on the app store (and then read it!), if they don't, solicit their feedback directly. Otherwise, if you want deep qualitative feedback, email some random customers directly and personally, and some will agree to give their opinion. How to use the findings, well, that's half of marketing making the most of data to position yourself.”- Jesse Friedman, Marketing and communications strategist

“You can get great quantitative feedback through a simple survey and then supplement by asking a few customers/users for feedback via a 30 min to one hour call.” - Jonathan Pipek, Product Marketer, Career Builder

Creating buyer personas

“A solid method to help you create buyer personas?If you have the time (and budget if you plan to go to an outside research firm) - is a combination of quantitative research, i.e. analyzing any data you have on your customer base and surveying existing customers and your hypothetical ideal prospects. And qualitative research - interviews with the same mix of current and prospective customers. Sales - and other internal customer-facing teams like customer success, support, etc. - is a decent proxy if you don't have time or budget. But you should absolutely find a way to interview some existing - and prospective - customers if at all possible.” - Lin Shearer, Founder & Principal Consultant, Spark Consulting

Want to learn more?

Market research is an invaluable part of not just product marketing, but the overall organizational function. It helps us to understand what prompts the customer to purchase products within the market and, ultimately, identify how we can position our products in such a way that they stand out from the crowd.

Our Market Research Certified: Masters course has been designed to help you streamline your approach for success. By the end of this course you’ll:

🧠 Understand the importance and benefits of research for making the most impactful and strategic decisions.

🧐 Know about the different types of data and where best to source it.

🔬 Be aware of the best research methods available for conducting valuable data for your company.

✌️ Be able to consider the ethical implications of market research and data collection.

So what are you waiting for?

Sign up

Follow us on LinkedIn

Follow us on LinkedIn

.svg?v=1461f28f41)