Does the thought of interacting with analysts send a shiver down your spine? It used to be a bone of contention for me and was an area I struggled with early on in my PMM career.

I’ve since come to appreciate the value they can bring, and in this article, I want to share what I wish I had known back then with you, including what factors influence your A/R strategy, why PMMs need to worry about A/R, the role of PMM in A/R, and more.

My name is Daniel Kuperman and I work at a company called Snowflake as the Director of Product Marketing. If you haven't heard about Snowflake, we are a cloud-based data warehouse, a fast-growing startup out of the San Francisco Bay Area.

As I was thinking about what to write about, one of the things looking back at my career in product marketing that I felt I really screwed up badly, especially in the beginning was analyst relations. So, I plan to share my stories with you, and hopefully, you can avoid the mistakes I made.

What does your analyst program look like?

Before I jump into it, think about your role as a PMM – in some shape or form, I wonder if you have any interaction with analysts within your industry? If you're in B2B tech, for example, it's very likely you're going to end up doing something with analysts. But do you like talking to analysts?

It's one of those things that is interesting. I didn't like actually talking to them in the beginning because what's hard is knowing how to do it. But I really came to appreciate the value that they can bring to the table, especially if you know how to use them.

I wonder how many of you have an analyst relations team or someone full-time doing analyst relations because if you have someone outside of the product marketing team (and some larger companies like Snowflake we just got someone for that analyst relations) it's great because they can take care of a tonne of stuff.

However, from a product marketing perspective, you still want to keep tabs on what's happening there for several reasons. So I’m going to jump into that. If you were to evaluate your analyst relations programs today, would you say it feels more like the image on the left or right?

I've been through both of them at multiple companies. Sometimes I feel like I'm being choked to death and other times the CEO comes like, "Hey, good job," and I'm thinking what did I do? It's interesting.

What I wished I'd known

What I wish I had known right and want to talk to you about in this article is there are certain factors that are going to influence your analyst strategy.

Why in product marketing, whether you have time, or you don't have time, why you need to make some time for analysts.

I'll also share a little bit about what I learned about our role as product marketing in interacting with the analysts and the team that does that.

Finally, I want to make sure that I leave you with some tangible things for you to either take back to your companies if you want to start your analyst program or if you want to evaluate or talk to the analyst team about, "Hey, are we doing these things?"

No analyst report will win a deal but it may very well derail one

This is something that always comes to my mind and it's kind of interesting because I have not seen any analyst report by itself win a deal. I haven't seen a sales rep come back to me and say, "You know what, that Gartner quadrant – that's why we closed the deal."

It helps but it's not because of that. Now, the corollary to that is you have the sales rep who is at the last final stretch of closing the deal and he comes back and says, "Oh my god, the prospect just brought up this analyst report," it may not even be a tier-one analyst, but whatever analyst "and he's now talking favorably about the competition" and suddenly the deal is on hold because they now need to evaluate.

It's one of those things where it might not help you win, but if you don't engage with analysts in a good way, it's definitely not going to help your cause and help you win deals.

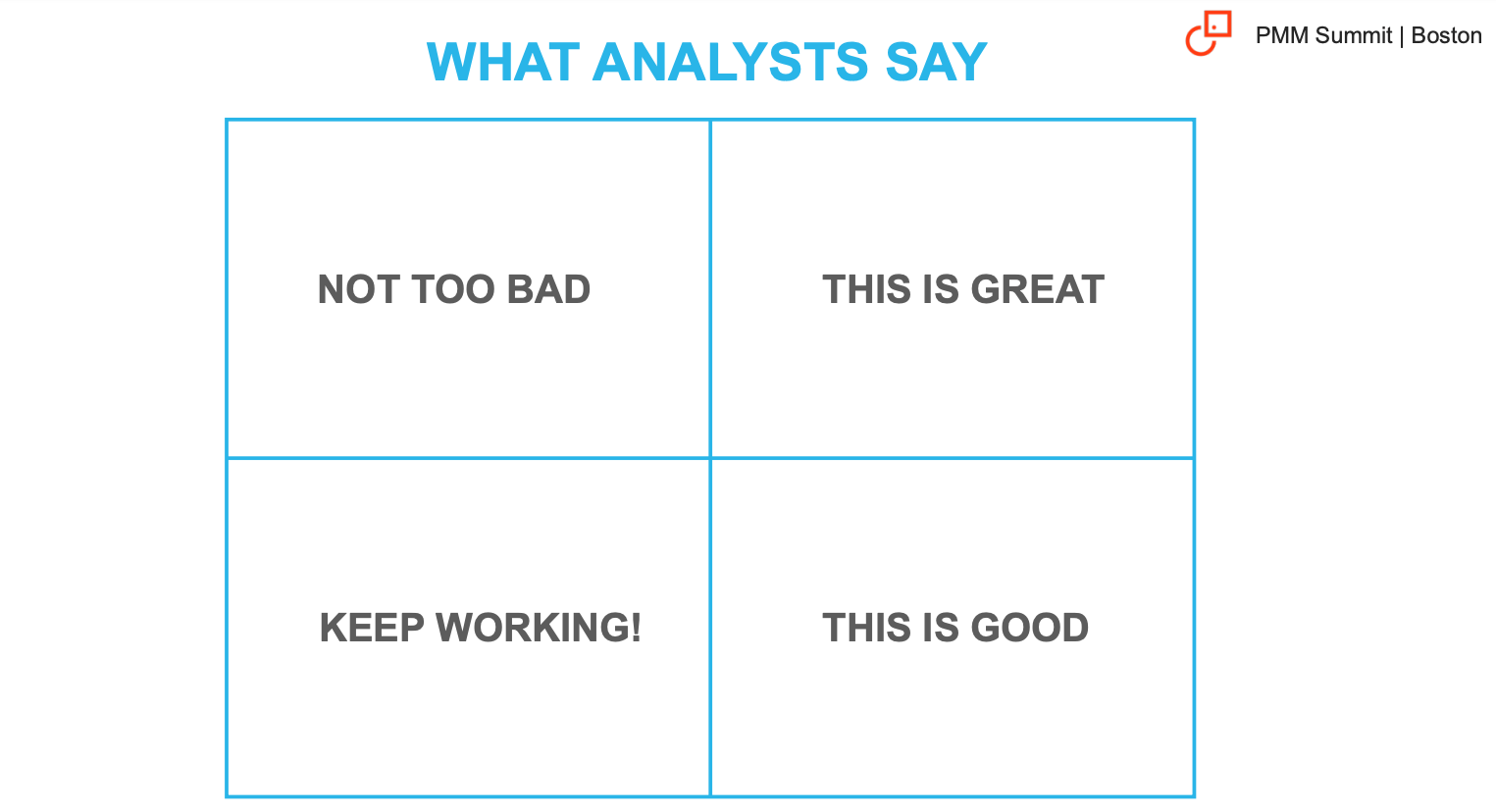

The Gartner Magic Quadrant

Having said that, there's something called the Gartner Magic Quadrant. If you're in B2B tech, we have somehow either been there or heard of it, or it's being shoved in our faces and this is kind of how the analysts are talking to us.

What analysts say

Typically upward into the right is great, right? And the analysts tell you, "This is great, you're doing great, you're a leader." If you're below that the analyst is going to keep saying, typically in the challenges quadrant right there, "Oh, you're doing good, feel proud of it."

If you're in the upper left here they say, "Not too bad, don't feel bad, this is great still." Every quadrant has a reason to be there and every company needs to feel like they belong to the quadrant.

If you're on the lower quadrant, he's going to say, "Yeah, keep working, one day you're gonna get there, you're not big enough don't worry about that." Well, that's easy for them to say.

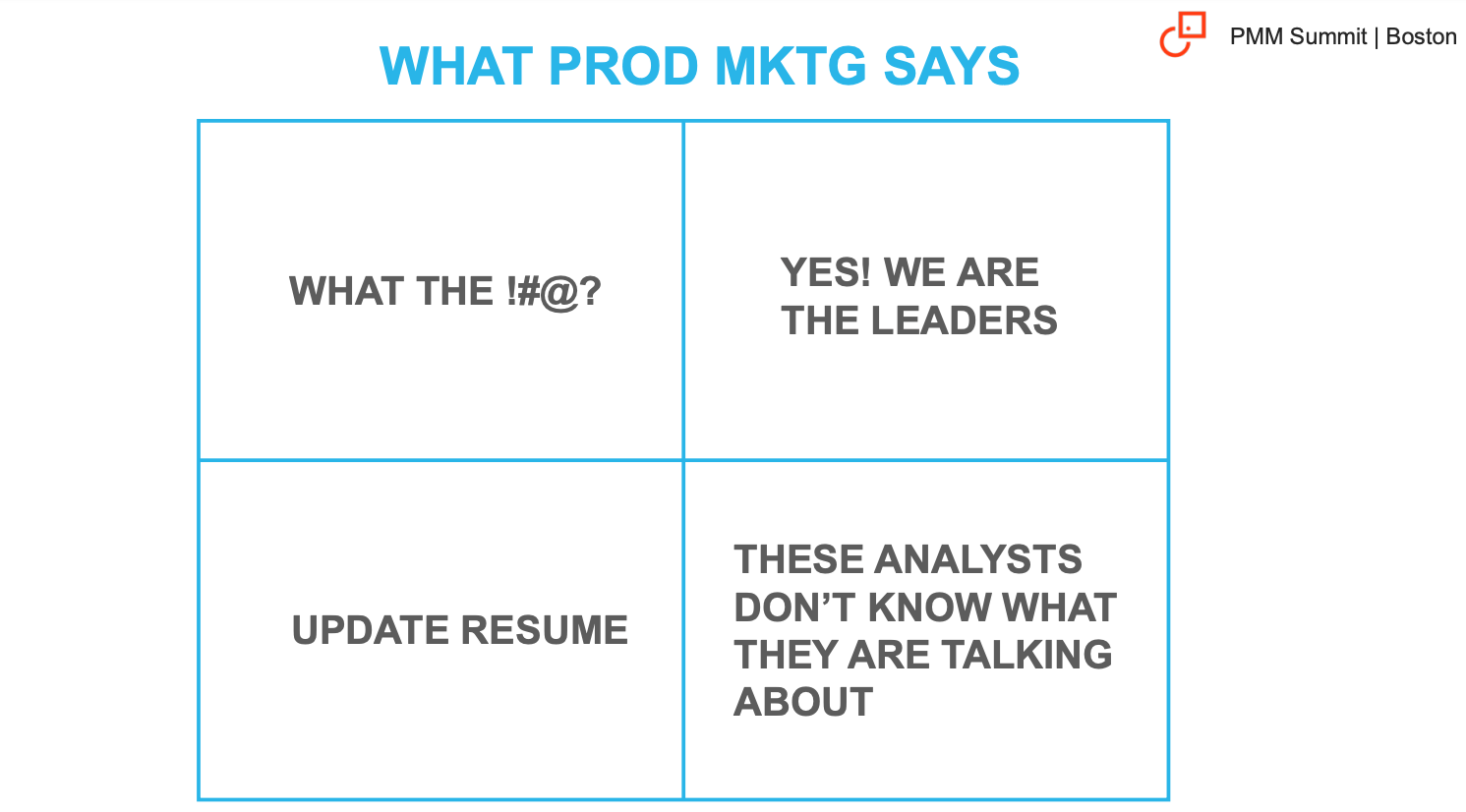

What product marketers say

The reality is, when you're up there you feel like you've done your job, you can go home at five o'clock, not at nine o'clock.

What the CEO says

The battle is what other people in the company see, especially what the CEO sees. If you've dealt with analysts, especially at a small organization, and the CEO comes to you and says, "Why are we paying these analysts?" It's because he was not happy with a quadrant.

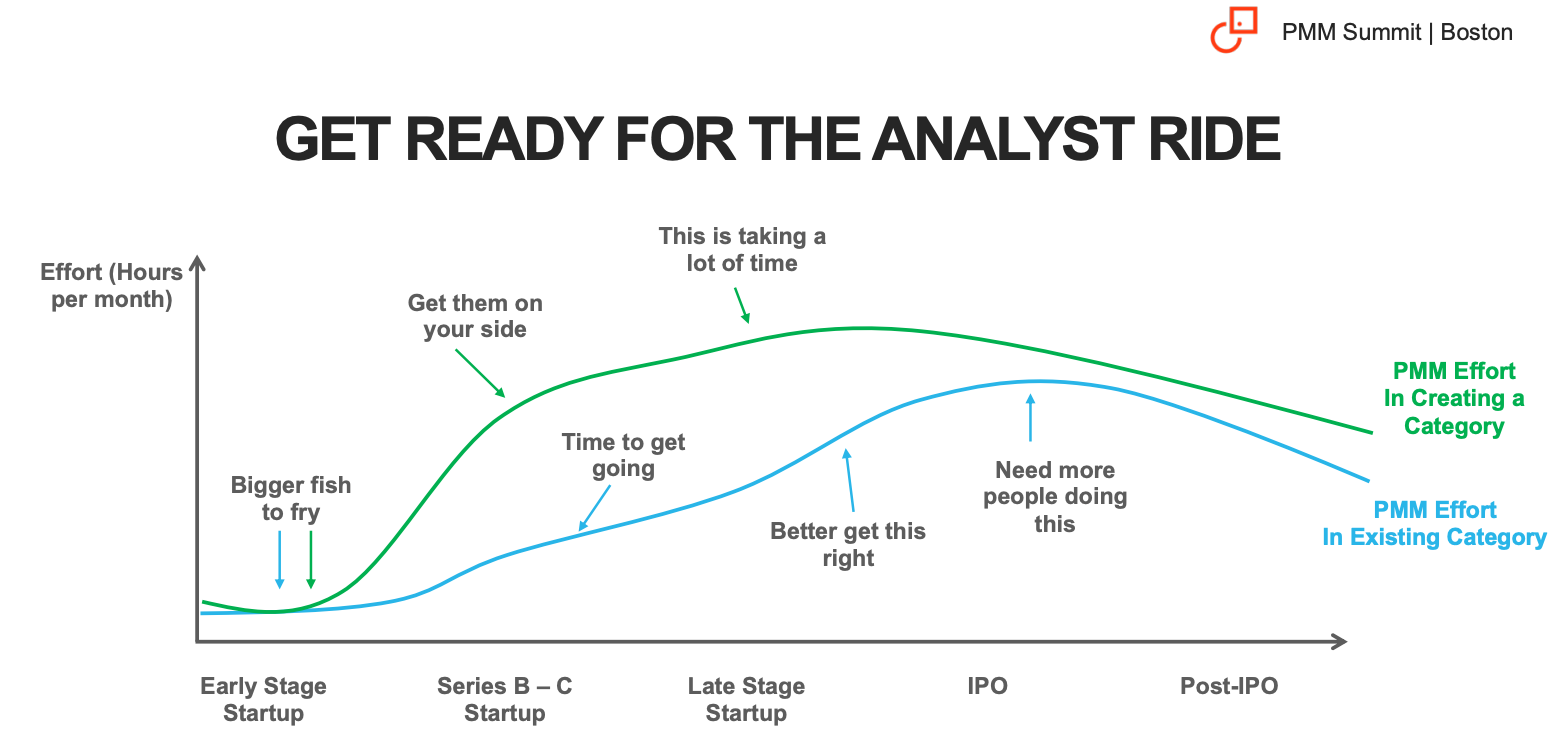

Having said that, an interesting thing of note is the amount of effort you're putting in with your analysts also depends on the life cycle of your company.

Get ready for the analyst ride

You don't want necessarily to put a lot of effort into this if you're at a super early stage in an existing category. What I've learned, at least from my experience, working in companies of different sizes of different stages, it's kind of like this graph…

So super early stage, you have other things to do, but you don't have time for that because you're not just doing product marketing, you're doing demand generation, you're doing the website, and why are you doing PR?

But as you get to Series B, okay now, we've got to get analysts involved so someone has to do that, who knows a product? Who knows how to talk to people? The product marketing person is typically thrown there. But after a while, you need more help.

For example, at Snowflake, we're definitely very close to the pre-IPO stage and that's why we're hiring more people and getting an analyst relations person on board to help scale that.

But also that's in an existing category. I've also been there at my previous company, where we were basically creating a category, no one knows what you mean by A, B, and C, where your effort begins way earlier than the typical time where you engage with the analysts. It still takes a lot of time, it doesn't matter.

How analysts help

Validate your company and solution in the market

This is my personal experience and I've been through all of this to help validate a company and the solution.

Help define and educate the market about a new category

If you're creating a category, it's extremely important for that to define and show the analyst report as a validation of what you're saying.

It's actually not just BS, right? There are more people in the industry for that.

Give market and competitive intelligence

When you're conducting market and competitive intelligence, if you learn how to ask the right questions to the analysts, you're going to get super deep insights as to what is happening in the market, that you may not know because you don't have time to track all of the 30 different competitors.

Because there are industries that you're not in yet but the analysts are, and because of what the customers, the analysts' clients, are telling them about their own evaluations of solutions like yours.

Assist with product and GTM priorities

The other part of this is assisting with product and go-to-market priority. I've taken product teams to meet with analysts to have them show the roadmap, so the analysts can say, "Why are you doing that?." Now they're hearing from the analysts and not from me. It helps you validate some of that stuff.

Unbiased sounding board

As an unbiased sounding board as well – it is great that we feel like we have the best product in the market but let's hear from someone else who is not buying, who doesn't care about buying it, and is really giving you their opinion based on what they know.

Of course, the corollary is analysts can be biased, so you've just got to take that with a grain of salt. That's why you have 2:1 for every analyst, so depending on who you're talking to and their experience.

Feedback on your sales team

It came as a complete surprise to me a couple of years ago when I heard an analyst telling me about what their clients were telling them about our salespeople.

This is something that the VP of Sales had no idea about and the CEO had no idea about, but the analysts said "Listen, it has happened now not once, but enough times that your sales team is coming across as arrogant," or as whatever, "That is because of a question that we ask like, what can you tell us about our sales in comparison to other competitors?"

They're like, "Well, now that you're asking this, let me tell you." This opened up another level of "Oh, my God, we need to do something about this."

Never underestimate the importance of internal communications!

Buyer insights

The buyer says, of course, we are talking to the people you're trying to sell to, learning how to leverage those insights. Some analysts like you to get Sirius Decisions, they have buyer reports ready for you to download of different personas.

Gartner has them for the more technical guys, the CIOs, and the IT managers. But regardless of that, you can also use them to help you understand what your buyers are trying to do.

Demand generation

Demand generation happens in a couple of ways. The basic one is licensing.

You can license those reports and that's where product marketing comes into play, what reports should we even think about licensing to help you with the webinars, to help you with demand generation?

But the other part of demand generation that I also have seen working is when analysts refer clients directly to you.

Investor validation

Finally, if you're an early-stage startup, investors – if you're trying to raise money – the VCs will call on the analysts, they will call anywhere between three to five different analysts companies, and they will ask the company, have you heard about this company? Have you heard about the market? Should I invest in this company or not? They do that.

What can blow up your analyst plan?

CEO and other top execs don’t get the point of A/R

One is the CEO and the other top execs don't get the point of analyst relations, why pay for this? It's important to get that internal alignment, otherwise, you're fighting a non-winning battle.

No one is responsible/owns the A/R strategy

The other thing that happens is "Let's get the product marketing person." Okay, if you're going to be responsible, they need to give you the responsibility for that with different things.

Being responsible means you need to own the message that's going to be told to the analysts, you need to be on the schedule, you're gonna own that, or you're gonna have to find somebody who can help you do that.

It can't just be ad hoc, "Oh, have you briefed the analysts this month?" No.

You treat it as a "pay for play" strategy

If you treat it as a pay-for-play strategy it doesn't work. At the end of the year, someone's gonna come to you and say, "Why are we spending $100,000 or whatever on analysts? I don't see us mentioned in their reports."

If you're thinking that because you up the amount you're paying, you're going to get mentioned, that doesn't work.

You are not honest in your interactions with the analysts

I used to work at this company, I'm not going to mention the name, but every time I went into a meeting with analysts where the CEO was there as well, I would walk out of the meeting learning something I didn't know about the product. Can we really do that? The CEO would say, "Oh, we will."

That's not good because what's happening is all the analysts are taking notes about what you're asking and what you're saying, in a lot of cases, those notes are recorded and transcribed.

Three months later, when you have the next call with them, the briefing, they're going to say, "So last time, according to my notes, you said this was going to be live, where is it?" And if you don't have it, and if you keep doing that over and over, you're going to lose complete credibility with the analysts.

It got to a point where I would not invite the CEO anymore to the meetings, and I would tell them, "Listen, I want to use you strategically, I don't want to waste your time." It was basically like, I don't want him here, because it's not gonna go well.

How can we help the company with analyst relations?

The role of product marketing in analyst relations

I've got 4 key things I've been thinking about that have helped me put analyst programs back on track.

Messaging

One is product messaging, and messaging is, of course, helping craft the story and the message we want to tell the analysts. It's not the same story and the message you tell to your prospects.

There are slight differences there which I'm going to talk a little bit more detail about.

Positioning

The second point is product positioning. Again, it's not just positioning against your direct competitors it's helping the analysts see you in the overall space against competitors, but also related to the trends that you were seeing in the market and how you're going to ride that wave or you're helping create the wave in the market.

Competitive

The third element is competitive and it's arming the analysts with how can they pitch your product for you? You might find that interesting, why is the analyst pitching?

But when clients call Gartner, Forrester, etc, they are going to ask who should I look at? And why should I see Company A versus Company B? That analyst needs to be able to say "This is how this company is different, they have A, B, and C – if you're looking for something else, you can go with this company" so they help clients shorten the list of who they are going to look at.

The client goes back to their boss and says, "Gartner told me I need to look at these three companies and they already told me how they're different." So you want to make sure that they know that. One good way to make sure that they know that is you ask them.

At the end of the call, "Okay, let me just ask you something. How would you now present this to a client if they ask how are we different?" It's funny because I just had a couple of calls recently where we had to correct the analyst because they said, "Well, my understanding is now that this feature does A, B, and C, you guys can do this." I'm like, "Okay, so let's step back."

Do not end the call there, we either need to dive deeper into this, or we need to have another call because, our mistake, maybe we went too fast. Then he's like, "Okay, now I got it, I wrote it down and what I'm going to say is this," perfect, awesome.

Discovery

The final thing is discovery – we're always looking for more market research and customer insights, and use analysts as part of the discovery process of what makes customers tick, and what is happening in the market.

Whether you are the one talking or you have someone else pitching the analysts, it could be your product manager, your VP, whatever, make sure that there are certain questions you want to get out there and you want to get that information back to the team so you can use that.

Your analyst deck

There are a few different flavors of analyst decks, I'll show you three examples here.

Example A

Imagine this is a vendor briefing where they call and you're meeting for the first time and talking about your company. You can have it segmented like this.

This is our company, this is our product, this is what we do, these are our happy customers, and this is the roadmap. Fairly standard.

Example B

Now, another way of phrasing that conversation is; this is our company, we have very smart people in the team, we're going super fast, we have a tonne of happy customers, and by the way, this is our solution.

Example C

Or you could also structure it like this; this is our company, this is our solution, this is how we're going to be positioning the market, this is how customers are using our product, and by the way, this is where we're going with this now.

A, B, or C?

You're better off structuring similar to the C option and I'll explain why that is.

What are the signs of a bad analyst meeting?

There are a couple of signs why you had a bad analyst meeting, and I've had all of these happen to me.

The analyst has no questions

In the end, they have no questions, which means they don't understand what you just said.

No time to ask questions

The analysts have no time to ask questions – also not good. You had let's say 45 minutes for the briefing, if you used all those 45 minutes, something's wrong. You should not do that because you always want to make sure that there's a little bit of room for questions and answers.

They can’t pronounce your company name

They can't pronounce your company name so that's obvious, which also happened to me.

The analyst thinks you're the same as your competition

This is the worst outcome of all of them. That's why when you're structuring your pitch to them, on the deck, think about how are other companies pitching.

So if you go back like most companies are going to be pitching like, this is who we are, this is our product, these are the great capabilities that we have, we are awesome.

Everyone's pitching them this way, so what are you going to do to show them how you're different? There are a few different things that make a great analyst deck.

What does a great analyst deck look like?

This is not just from me, but I look up and talk to different analysts, and always ask them what was it about the presentation that they liked the most.

One of the best things that you can do is – at the end of the session – ask the analysts for feedback.

I was on a call a couple of years ago at another company and I asked the analysts, "So just honestly, we still have 10 minutes left, what do you think? Did we, did I, do a good job differentiating my company or not? What could I have improved?"

I just openly asked that and what the analyst told me was, "Daniel, your presentation was the same as every other vendor in your market. I don't understand how you guys are different. What I'd like to see from you. (And that's where I started taking notes) is the following."

There are a few interesting things that you need to structure your presentation around.

Awareness

One is awareness, and it's not just who we are as a company, but making sure that they are aware of what you do, aware of who you are, aware of the market you operate in, and aware of who is the ideal buyer.

You can't just say everyone can buy, it's typically you come in and you say "Cross-industry, any CEO in the market can buy our product," be very specific, the ideal customer profile, if the analyst knows that bang, they can also help you identify potential customers and it happens.

Differentiation

You need to be able to differentiate not just about your product, but about the market itself and your solution.

Demonstrate

Demonstrating is not just doing a product demo, but it's demonstrating exactly how a customer uses your product.

Evidence

The evidence is, what are the results customers are getting? What I've learned when talking about features is if I'm going to show something new to the analysts I could do a very short demo just to show these exist, but then I want to walk them through how a very specific company that I'm going to name to the analyst uses a product and the results you're getting.

Because once they hear that the understanding sinks in. It's storytelling 101. "Let me tell you about company ABC, they were having this problem and this is what happened. And now we came in, and we are the hero" and why they became the hero of the story, so analysts can then repeat that, and they can understand better how you're different.

The analyst relations plan

There are 4 key things from a product marketing perspective that I always want to make sure that either I am doing or someone else on the team is doing about the plan; goals, schedule, people, and tracking.

Plan components

Goals

Goals are around clarity and alignment. If the CEO is only interested in getting you up on the right quadrant, we know they are, but what else are we trying to get out of the analyst relations plan?

There needs to be alignment, not only across your team but across the company. So people know what we are doing with Gartner and Forrester, etc.

Schedule

Schedule is important from a couple of perspectives. One is, depending on the analyst here, you want to spend more time with tier one analysts than tier three analysts. Your tier-one analysts can't be more than three firms, you don't have time unless you have all the resources in the world to go after 10 different firms with the same message and the same cadence.

You want to space them out. You might do some quarterly, we might do some annually, and you might talk to some semi-annually. And then tying that to the roadmap.

Not every feature requires a briefing so you want to pace that out and also understand which ones, which analyst firms, would be more interesting.

People

Make sure you leverage people around the company who can be spokespeople as well for analysts and that means not just on calls but if you meet them face to face or at trade shows.

If you go to analyst trade shows you may want to have your VP of product or a product manager, just shake hands with them. They don't need to be on an hour-long meeting but introduce them to other people in your company and leverage other spokespeople and subject matter experts.

Tracking

Finally, the tracking part of this is important because you want to make sure that in the end, if you're spending all that time, you can go back to that and show these are some of the things that we accomplished with our analyst plan. That's why we need to renew or we need to cancel the subscription.

Metrics

I have some examples here of potential metrics. These are some that I've used in the past, related to how many mentions are we getting in those reports?

The volume of inquiries with your company mentioned

The volume of inquiry, so if your subscription to Gartner, for example, tracks every time a client calls the analyst and the client asks the analyst about a product, a company, an industry, etc. The analysts are tagging those calls.

Later, they can run reports and they say do we need an extra analyst for this product, this solution? You can ask the analysts what the volume of inquiry calls you're getting about product eight, what is the volume you're getting based on different industries, based on different personas? The analyst teams, especially at the larger firms, can give you all of that.

Number of reports mentioning your company

And guess what? You can then use that as part of your plan to say how are we getting mentioned, if we're not, which are the competitors that are getting more mentions? That might mean they're moving into the market and getting help with competitive analysis.

Scores of placement in report vs competitors

Scores, placements in reports, this is like where you're replacing in the quadrant and everything, but also leaves an opportunity.

Leads and opportunities generated

At my previous company, we had a couple of times, clients coming to us and saying "Analyst A recommended I talk to you guys."

Guess what, we just went to the top of their list of potential vendors. It just bypassed everything, they wanted to see a demo. It doesn't happen often but if you do your work, it can be a great help.

Deals influenced by analysts

It can be tricky to track that unless it's one of those situations where they call you and they say "This analyst told me I should talk to you." You're going to have to track that via attribution campaigns from the marketing team, or wherever tradeshow events or even it could be more anecdotal, but you want to start tracking if analysts are influencing or not.

If you're using analyst reports to help close deals, you want to make sure you can track which deals were used with each report.

Tactical advice

There are a couple of things that I've noticed as I'm working with other people doing analyst relations and even the analyst relations teams.

One is around helping them really understand how to position and message the different analysts. This is one of the key things you want to make sure that you're embedded in. You don't need to do that all the time, have a checkup meeting with whoever is running the program, and say, "Guys, can I just take a look at the deck we're using?"

I did that at a previous company and I noticed that was not the latest deck so we were missing an opportunity.

There are some minor things you want to make sure you do as well as looking up the analysts before you talk to them, that seems obvious, but you'd be surprised at how many meetings you go with other executives of the company, and you're like, "What is this analyst about? What have they written?"

You want to address the analysts based on what they've written. It's almost like talking to someone in a media company, if they've written articles about you and those keywords, you want to make sure you know about that stuff.

Signs your analyst plan is working

A few signs that your plan is working.

Mentions in reports

If you're mentioned in a report, that's obvious. How many times Are you mentioned? How are you being mentioned? Are you being mentioned as a leader? Being mentioned as an example?

For example, Gartner has the life cycle or the hype cycle they call it, you can be mentioned as an example of a category, or your competitor can be mentioned. If you look at whether or not your competitor is being mentioned in categories or as an example of solutions where you are not, you want to make sure you're correct.

Mentions in presentations

Mentions in presentations are great. Analysts have their own conferences, and sometimes they go to other conferences to present. When they talk about the industry, invariably they use an example from the industry.

I've had analysts using screenshots of my product as an example of a best practice. Taking that back to the team, and sharing that in two Gartner presentations, they show not only our product name as a leader, but they showed a product screenshot – they ripped out the name, that's fine because they want to seem to be biassed – but look at what we're doing. That helps a lot.

Analysts ask for input

Analysts ask for your input, they're writing a report, and they reach out to you, "Hey, can you connect me with a customer that has this situation?" Because what they're doing is reaching out to all the vendors in the space and asking the same question.

How fast you can connect them with a customer with the right example that they're looking for, the better the chance is that your customer is going to be mentioned in the report, and then what happens is your customer feels good about it and the analysts now also have a better perspective of who you are.

Lead generation

And I already talked about lead generation earlier in the article.

Thank you.

Follow us on LinkedIn

Follow us on LinkedIn

.svg?v=3c4c23cd72)